Introduction to Online Bank Account

In today’s digital age, Online Bank Account an on line bank account is an crucial economic tool for individuals and organizations alike. The comfort and accessibility of managing budget from everywhere at any time have made online banking increasingly popular. This article delves into the advantages, security measures, and capabilities of an internet bank account, providing a comprehensive information of why it is a desired desire for plenty.

Features of an Online Bank Account

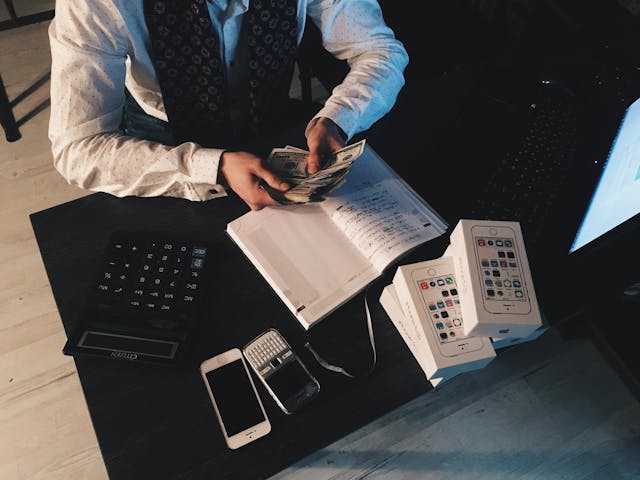

An on-line bank account generally comes with more than a few capabilities designed to simplify banking. These consist of mobile banking apps, online invoice pay, and the ability to transfer funds between accounts seamlessly. Many online banks additionally provide budgeting gear and financial planning sources to help users manipulate their cash greater efficaciously. Furthermore, the integration with virtual wallets and charge systems provides every other layer of comfort for everyday transactions.

Benefits of an Online Bank Account

One of the number one benefits of an on-line financial institution account is the benefit it gives. Users can get entry to their debts 24/7, carry out transactions, and manage their finances without the need to visit a physical financial organization. This diploma of accessibility is particularly useful for people with busy schedules or who stay in far off areas. Additionally, online financial institution debts frequently come with decrease costs and better interest costs compared to traditional financial institution money owed, making them a cost-effective choice for plenty.

Security of an Online Bank Account

Security is a essential consideration on the subject of coping with price range on-line. An on-line bank account is ready with advanced safety features to protect customers’ personal and economic information. These measures consist of encryption, two-thing authentication, and non-stop monitoring for suspicious activities. Online banks also observe regulatory standards to make certain the protection of their customers’ information. It’s vital for users to comply with pleasant practices, such as the usage of strong passwords and being cautious of phishing attempts, to similarly decorate their account safety.

Opening an Online Bank Account

Opening an online financial institution account is a straightforward manner that can be completed in just a few minutes. Applicants usually need to offer personal statistics, consisting of their call, address, and Social Security wide variety, and may be required to submit proof of identity. Once the software is authorized, users can fund their new account thru electronic transfers or mobile take a look at deposits. Many on-line banks provide signal-up bonuses and incentives to draw new customers, adding to the enchantment of on-line banking.

Managing Finances with an Online Bank Account

Managing price range with an online bank account is both efficient and effective. Users can set up computerized payments for recurring payments, track their spending in real-time, and acquire indicators for crucial account sports. The capacity to categorize transactions and generate monetary reports allows users stay on top in their budgeting goals. Additionally, the integration of investment and savings bills inside the online banking platform presents a comprehensive view of 1’s monetary fitness.

Customer Support for Online Bank Account Holders

Customer aid is an essential factor of any banking service, and an on line financial institution account is no exception. Online banks provide numerous channels for customer service, which include stay chat, cellphone assist, and e-mail. Many also provide substantial on line assets, such as FAQs and tutorials, to help customers navigate their banking experience. While the lack of physical branches may be a concern for some, the availability of sturdy customer service ensures that users can get help whilst needed.

Conclusion: Embracing the Future with an Online Bank Account

As generation continues to improve, the prevalence of the on-line financial institution account is about to grow. Its convenience, value-effectiveness, and revolutionary features make it an attractive alternative for modern banking needs. While security stays a pinnacle precedence, the measures in area provide a excessive degree of protection for customers’ monetary statistics. By understanding the blessings and talents of a web financial institution account, individuals and organizations could make informed selections about their banking choices and include the future of digital finance.